Unlock International Riches Administration With Offshore Financial

The complexities of international money demand an innovative understanding of overseas financial and its possible to enhance international wealth management. By leveraging offshore accounts, individuals can not only secure their assets however also browse the ins and outs of tax optimization and personal privacy.

Recognizing Offshore Banking

Offshore financial stands for a strategic financial option for individuals and businesses seeking to manage their assets with greater versatility and security. An overseas financial institution is an economic establishment located outside the account holder's country of home, commonly in territories known for desirable regulative environments. These banks commonly supply a variety of services, consisting of savings accounts, investment possibilities, and finances, customized to satisfy the varied requirements of their customers.

One essential facet of overseas financial is the legal framework that regulates these establishments. Many overseas banks operate under stringent guidelines, guaranteeing conformity with international regulations while guarding the privacy and possessions of their clients. This legal structure can offer a protective layer against political and economic instability in an account holder's home nation.

In addition, overseas banking can promote worldwide deals, enabling clients to carry out business throughout borders easily. This facet is specifically helpful for expatriates, global entrepreneurs, and frequent vacationers. Recognizing the intricacies of offshore financial, consisting of both the potential advantages and the governing requirements, is crucial for any individual considering this monetary opportunity. Via educated decision-making, clients can effectively take advantage of overseas banking to boost their financial methods.

Benefits of Offshore Accounts

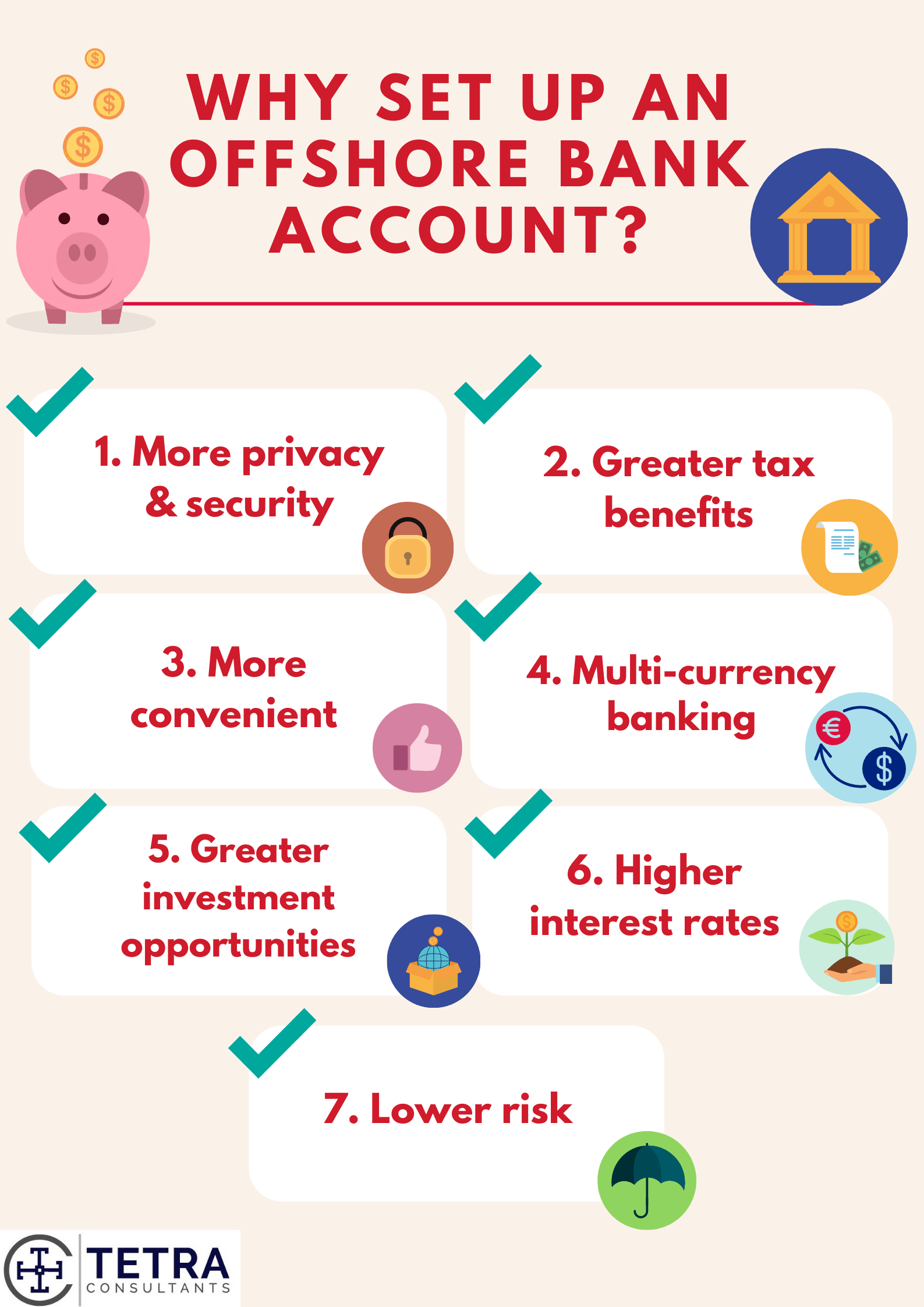

Among the various economic approaches available, overseas accounts use several unique benefits that can considerably improve an individual's or business's financial monitoring. Among the key advantages is property defense; offshore accounts can work as a guard against political instability, financial slumps, or lawful disputes in the account owner's home nation. This safety layer is particularly appealing to high-net-worth individuals seeking to maintain their riches.

In addition, overseas accounts usually give improved personal privacy. Numerous territories have stringent discretion regulations that limit the disclosure of account information, permitting clients to maintain a higher degree of monetary discretion. This personal privacy can be essential for those looking to safeguard delicate financial information.

Another significant advantage is the capacity for tax obligation optimization. Relying on the territory, people and organizations might take advantage of beneficial tax rates and even tax exceptions, enabling more reliable wide range buildup.

Selecting the Right Jurisdiction

Selecting the appropriate jurisdiction for an overseas account is a crucial choice that can influence the efficiency of the economic advantages previously described. Jurisdictions differ in terms of regulative frameworks, tax effects, and levels of privacy, every one of which play a considerable role in the general energy of an offshore banking technique.

When evaluating prospective territories, consider elements such as political stability, economic atmosphere, and the credibility of the banking system. Countries understood for robust economic services, such as Switzerland, Singapore, and the Cayman Islands, commonly offer a protected and personal financial experience. Additionally, it is vital to evaluate the legal framework governing offshore accounts in the chosen territory, as well as any type of international contracts that may affect your properties.

Furthermore, tax obligation nonpartisanship is an important facet to keep in mind. Some jurisdictions provide tax motivations that can improve the benefits of offshore banking, while others might impose strict taxation on foreign-held possessions. Inevitably, selecting the right jurisdiction requires comprehensive study and maybe the guidance of economic experts to make sure that the picked place aligns with your details economic goals and risk resistance.

Approaches for Asset Security

Implementing effective strategies for property defense is crucial for guarding riches against potential risks click this such as lawful cases, political instability, or financial downturns. One key approach is the establishment of overseas counts on, which can give a layer of separation between personal possessions and prospective creditors. By putting assets in a trust, individuals can protect their riches from cases while gaining from desirable tax treatment in certain territories.

Another technique entails using restricted liability entities, such as offshore companies or restricted liability firms (LLCs) These frameworks can protect personal possessions from company obligations and give privacy, making it a lot more challenging for claimants to accessibility personal riches.

Diversity of properties throughout numerous territories is likewise critical. Holding financial investments in several nations can minimize dangers connected with any kind of single economic situation's slump. Additionally, buying tangible assets, such as property or rare-earth elements, can offer more protection against currency decline and inflation.

Last but not least, routinely examining and upgrading asset protection techniques in reaction to altering legislations and personal situations is vital - offshore banking. Positive administration of riches makes sure that people continue to be prepared for unforeseen obstacles in an ever-evolving international landscape

Steps to Open an Offshore Account

First, conduct detailed research to determine an appropriate offshore jurisdiction. Factors to take into consideration consist of governing security, banking reputation, and tax obligation implications. Popular choices typically consist of Switzerland, Singapore, address and the Cayman Islands.

Next, pick an economic establishment that meets your needs. Testimonial their services, charges, and account types. It's sensible to pick a bank with a strong track record for customer support and safety.

When you have actually selected a bank, you will certainly need to gather the needed paperwork. offshore banking. Usually, this includes evidence of identification (such as a copyright), proof of address, and economic statements. Some financial institutions might likewise need a recommendation letter or a resource of funds declaration

After assembling your papers, send your application, ensuring it is full and exact. Be prepared for a due persistance procedure, which may entail meetings or added documents demands.

Final Thought

By using efficient techniques for guarding assets and recognizing the procedural steps to develop an overseas account, investors can navigate the intricacies of international finance. Inevitably, offshore financial represents an effective device for achieving financial safety and security and growth in a progressively interconnected globe.